Industrial for sale in Silk Street, Congleton CW12

* Calls to this number will be recorded for quality, compliance and training purposes.

Property description

Garage Workshop and Premises

Ground Floor Total NIA 190.6 m2 2051 sqft

Total First Floor NIA 59 m2 635 sqft

Total Combined NIA 249 m2 2680 sqft

A self contained garage and workshop premises located in a light commercial area being centrally positioned within Congleton Town Centre. The property is positioned at the end of Silk Street, having passed several similar style garage businesses.

The vendor has successfully traded in performance car tuning for 3 decades plus, two of which have been at the site. The sale of the business is only due to retirement. A big part of the operation id focused around the specialised rolling road. This is a big cost item which can be acquired by separate negotiation.

The brick constructed building features an asbestos roof, 3 phase electric oil fired heating and briefly comprises: Enclosed yard; main workshop with mezzanine store; long store; rolling road garage bay with mezzanine store above; office; wash area and W.C.

This self contained rare property offering is sure to appeal to a wide variety of affiliated established business owners looking to move away from expensive annual rent costs to asset accrual/ property investment.

Business Rates

Garage floor areas

DescriptionArea m2/unit£ per m2/unitValue Help with Value

Ground floor garage115.5£44.85£5,180

Ground floor canopy44.3£6.73£298

Total159.8 £5,478

Additional details

DescriptionArea m2/unit£ per m2/unitValue Help with Value

Unsurfaced, fenced land252£1.50£378

Total £378

Valuation

Total value£5,856

Rateable value (rounded down)£5,800

Small Business Rate Relief

Small business rate relief

You can get small business rate relief if:

Your property’s rateable value is less than £15,000

your business only uses one property - you may still be able to get relief if you use more

You cannot get small business rate relief and charitable rate relief at the same time. Your local council will decide which type of relief you’re eligible for.

What you’ll get

How much small business rate relief you get depends on your property’s rateable value.

You will not pay business rates on a property with a rateable value of £12,000 or less, if that’s the only property your business uses.

For properties with a rateable value of £12,001 to £15,000, the rate of relief will go down gradually from 100% to 0%.

Example

If your rateable value is £13,500, you’ll get 50% off your bill. If your rateable value is £14,000, you’ll get 33% off.

If you use more than one property

When you get a second property, you’ll keep getting any existing relief on your main property for 12 months.

You can still get small business rate relief on your main property after this if both the following apply:

None of your other properties have a rateable value above £2,899

the total rateable value of all your properties is less than £20,000 (£28,000 in London)

How to get small business rate relief

Contact your local council to:

Check if you’re eligible

find out how to get small business rate relief

check if you can get any other types of business rates relief on top of small business rate relief

If your circumstances change

Report changes to make sure you’re paying the right amount and do not get a backdated increase in your bill or overpay.

Contact your local council if:

Your property becomes empty

you get another property

you make any changes to your property that would increase its value - for example, extending or renovating it

the nature of your business changes or it moves to different premises

The amount of small business rate relief you’re eligible for may change. For example, it may decrease if the rateable value of your property has increased.

You’ll usually need to pay your new rate starting from the day your circumstances changed.

Check which changes in circumstance you need to report to the Valuation Office Agency (voa).

If you think you should be getting small business rate relief but are not

Contact your local council if you’re not getting small business rate relief and you think you’re eligible for it.

If you think your rateable value is wrong

You can challenge your property’s rateable value with the voa. Use your business rates valuation account to do this.

If you’re getting less small business rate relief since 1 April 2023

You may be eligible for the supporting small business relief scheme if you’ve lost some or all of your small business rate relief because of the revaluation on 1 April 2023.

Find out more about the supporting small business relief scheme.

If you’re a small business but do not qualify for small business rate relief

Your business rates bill is calculated using a ‘multiplier’ - your rateable value is multiplied by this number to get your final bill.

If your property has a rateable value below £51,000, your bill will be calculated using the small business multiplier, which is lower than the standard one. This is the case even if you do not get small business rate relief.

The small business multiplier is 49.9p and the standard multiplier is 51.2p from 1 April 2023 to 31 March 2024. The multipliers may be different in the City of London.

Find out how to estimate your business rates bill.

You may be eligible for another type of business rate relief. For example, if:

You have a retail, hospitality or leisure property

you are in financial difficulty

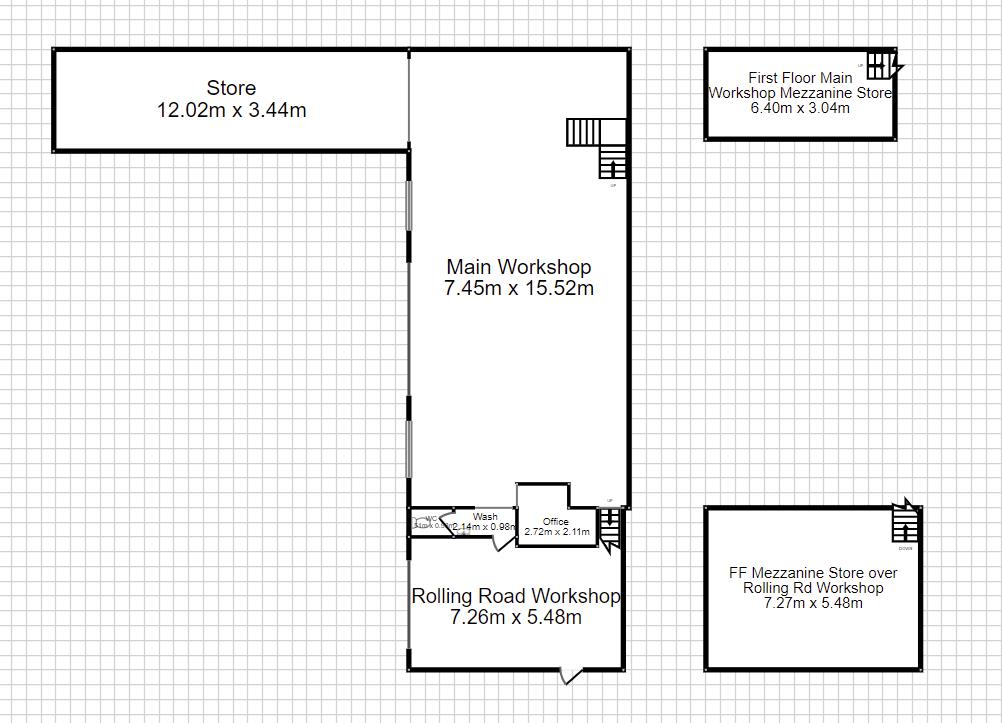

Main Workshop (15.58 x 7.46 (51'1" x 24'5"))

NIA approx 112 m2 1205 sqft

Main Workshop First Floor Mezzanine Store (6.4 x 3.05 (20'11" x 10'0"))

NIA approx 19 m2 210 sqft

Long Store Room (12 x 3.47 (39'4" x 11'4"))

NIA 41.64 m2 448 sqft

W.C.

NIA 1.49 m2 16 sqft

Wash Area

NIA 2 m2 21 sqft

Office

NIA 4.96 m2 53 sqft

Rolling Road Workshop (4.5 x 7.28 (14'9" x 23'10"))

NIA approx 30 m2 322 sqft

First Floor Mezzanine Store Over Rolling Rd Worksh (7.3 x 5.62 (23'11" x 18'5"))

NIA approx 40 m2 430 sqft

Yard

Approx 200 sqm 2152 sqft

Net Internal Area

Ground Floor

Main Workshop 112 m2 1205 sqft

Long Store Room 41.64 m2 448 sq ft

Rolling Road Workshop 30 m2 322 sqft

Office 4.96 m2 53 sqft

Wash Area 2 m2 21 sqft

W.C. 1.49 m2 16 sqft

Ground Floor Total NIA 190.6 m2 2051 sqft

First Floor

Over Main Workshop Mezzanine 19 m2 210 sqft

Over Rolling Road Workshop Mezzanine 40 m2 430 sqft

Total First Floor NIA 59 m2 635 sqft

Total Combined NIA 249 m2 2680 sqft

Property info

For more information about this property, please contact

Chris Hamriding Letting & Estate Agents, CW12 on +44 1260 607324 * (local rate)

Disclaimer

Property descriptions and related information displayed on this page, with the exclusion of Running Costs data, are marketing materials provided by Chris Hamriding Letting & Estate Agents, and do not constitute property particulars. Please contact Chris Hamriding Letting & Estate Agents for full details and further information. The Running Costs data displayed on this page are provided by PrimeLocation to give an indication of potential running costs based on various data sources. PrimeLocation does not warrant or accept any responsibility for the accuracy or completeness of the property descriptions, related information or Running Costs data provided here.

.png)